Rumored Buzz on Tax Attorney

Table of ContentsTax Attorney Things To Know Before You Get ThisAll about Tax AttorneyRumored Buzz on Tax Attorney5 Easy Facts About Tax Attorney DescribedNot known Details About Tax Attorney 4 Simple Techniques For Tax AttorneyNot known Incorrect Statements About Tax Attorney

What is your highest possible level of education and learning?

Fascination About Tax Attorney

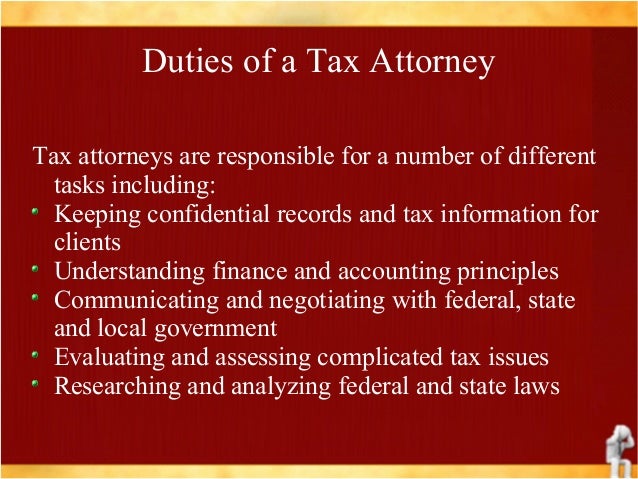

This will often prompt the federal government to examine its regulations. It's important to have a fondness for reading case legislation as well as guidelines, as this is just how juniors will certainly spend some of their time. They must have the ability to reason their findings and summarize them properly. Tax lawyers must have complete self-confidence in their suggestions.

Excellent social skills are a must. Tax obligation dispute can in some cases entail liaising with the internal revenue service, as well as it is essential that attorneys be upfront and straight-talking. They might additionally collaborate with worldwide clients, so cultural recognition is essential. Legal representatives have the possibility to service a range of issues, including charity and also pro bono (Tax Attorney).

Trump had been the very first governmental prospect to reject to launch his tax obligation documents in the last 4 years. The Area Attorney of New York is examining whether Trump or his company fully commited tax and insurance policy fraud. The Organization for Economic Co-operation as well as Advancement (OECD) has likewise suggested extensive reforms to worldwide tax.

The Definitive Guide to Tax Attorney

In addition to this, the OECD is likewise focusing on elevating tax income from digital businesses based upon the place of users. There were issues that this unilateral tax obligation would fall disproportionately on big US technology as well as internet companies. The IRS's 2021 record showed tax reimbursements are down 32% contrasted with the same time in 2014.

The US is the just major economy not to have a value-added tax obligation (BARREL) system. There is a belief among some specialists that a federal VAT system might be and ought to be presented in the future. Eleven states now tire recreational marijuana: Alabama, Arizona, The Golden State, Colorado, Illinois, Massachusetts, Michigan, Maine, Nevada, Oregon and also Washington.

The state invests the profit on healthcare programs., elderly counsel, "It is essential to keep your eyes as well as ears open up to ensure you understand whatever concerning the transaction so your suggestions is the most effective it can be." "You don't need to be a math brilliant to be a really effective tax obligation lawyer.

Our Tax Attorney Diaries

That's where one of the most click this site interesting work will ultimately be for young lawyers, so language skills are extremely essential.".

Tax obligation Accounting professional duties consist of: Preparing tax obligation payments Approximating as well as tracking income tax return Completing routine (quarterly and also annual) tax obligation reports Job short, We are searching for a Tax obligation Accountant to prepare tax repayments as well as returns for our business. To prosper in this role, you need to show passion in following changes to tax obligation guidelines and also laws.

When taking care of your taxes, there are certain points an accountant or CPA can handle for you, and particular points that need the services of a tax obligation lawyer. Tax regulation is complex, and highly technical, as well as a tax attorney specializes in the great factors the details, great print, and also ever-fluctuating state codes and also government policies of our taxes system.

6 Easy Facts About Tax Attorney Explained

When To Get In Touch With A Cincinnati Tax Attorney If you are dealing with disputes over your state or government tax returns, either for the most current year or for previous year, then speaking with a tax obligation attorney is a wise suggestion. There are many various other reasons you might want to talk with an attorney, though: You are starting your very own organization.

Your job entails global customers as well as you need aid with international law or tax obligation scenarios with international governments. Importing and exporting throughout state lines has tax obligation repercussions, however what about into and also out of international countries? Who obtains taxed and also when? Just how do you stay clear of obtaining double-taxed by both governments? The IRS he has a good point is examining you for criminal misdeed, or you mean to prosecute against the internal revenue service.

An accountant, nevertheless, has an obligation to share those conversations with the court. Therefore, the guidance of a tax obligation lawyer is frequently better if your company activities have actually obtained you right into hot water concerning your tax obligation obligations. We Help With Simple as well as Challenging Tax obligation Concerns Tax obligation regulation is labyrinthine.

Not known Incorrect Statements About Tax Attorney

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-513067681-57c9117d5f9b5829f4600111.jpg)

By having your account teaming up with your tax obligation lawyer, you can allocate funds in the best as well as most cost-efficient manner. You can secure on your own and your employees, while maintaining your corporate tax obligation problem to a minimum. Below in Cincinnati, the tax obligation attorneys at Donnellon, Donnellon, & Miller are well versed in all aspects of neighborhood, state, as well as federal taxation.

Whether they are entry degree or have decades of hands-on experience, attorneys mostly make a comfortable living. Their average annual wage click this site in the USA is virtually $127,000, according to one of the most recent data available from the U.S. Bureau of Labor Stats, though it differs based on the sort of regulation.

Examine This Report about Tax Attorney

How Much Does an Earnings Tax Attorney Earn? According to federal government data gotten by, the average salary for a tax attorney in the United States is $120,910 per year.